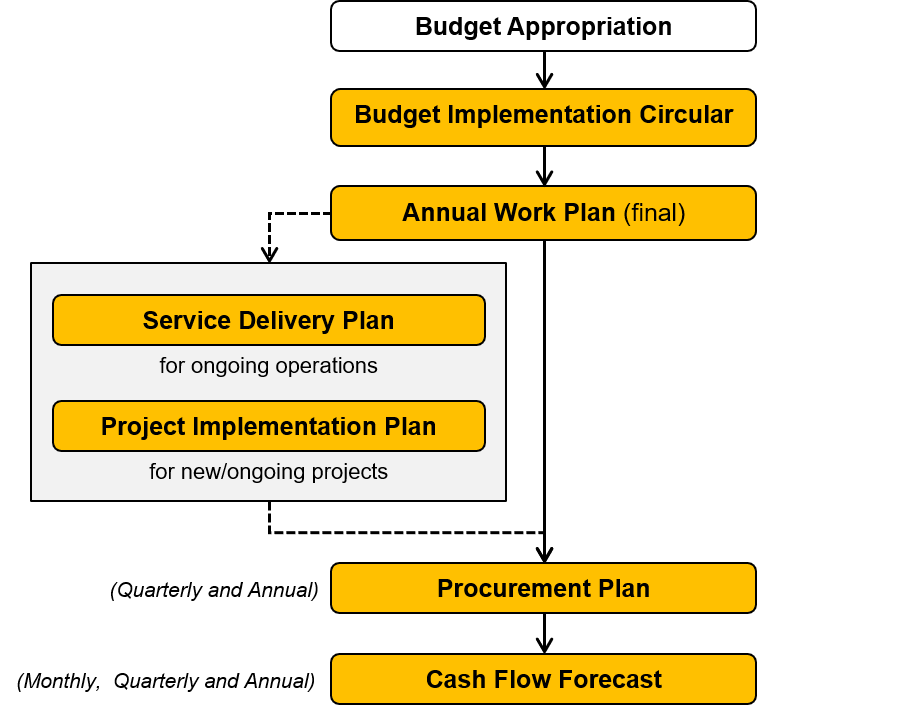

As soon as the new fiscal year begins on July first and the budget and appropriation are approved, county departments can begin implementation of activities. The multiple processes governments go through in this phase can be divided into two groups: (1) Work Planning, and (2) Budget Execution.

In this phase County Departments translate budgets into actionable plans. Guided by the Budget Implementation Circular, work plans, earlier drafted during budget preparation, are finalized and ordered into service delivery and project implementation plans to capture ongoing operations and new and/or ongoing projects, respectively. Work plans are consolidated and assessed vis a vis the expected flow of revenues to develop realistic procurement plans and cash flow forecasts. Work planning tends to be an internal process solely within the preserve of the County Executive.

| 1 |

This circular, issued by County Finance and Economic Planning at the beginning of the fiscal year following budget appropriation, provides practical guidance and instructions to departments on budget implementation

|

4 |

This work planning by-product specifies activities and units/persons responsible for project implementation outputs, and the resources allocated these outputs. As with the work plan, it is presented on a quarter-by-quarter basis.

|

| 2 |

This plan outlines and specifies – normally on a quarterly basis - the activities and outputs targeted from the utilization of allocated budget resources, and the units/persons responsible for its implementation. A draft is typically prepared during budget preparation and finalized after budget appropriation.

|

5 |

This plan translates the work plan into a schedule of all works, good and services to be purchased or contracted, across the procurement cycle from orders to delivery to supplier payment. As with the work plan, it is presented on a quarter-by-quarter basis.

|

| 3 |

This work planning by-product specifies activities and units/persons responsible for service delivery outputs, and the resources allocated to such delivery. As with the work plan, it is presented on a quarter-by-quarter basis.

|

6 |

This forecast translates the work plan ( procurement plan and SD plan) into cash flow requirements, based on expected payment dates and amounts. Cash flow forecasts must be approved by the Controller of Budget before funds are released to counties. It is prepared on a quarterly, and often monthly, basis.

|

Implementation and Service Delivery Planning

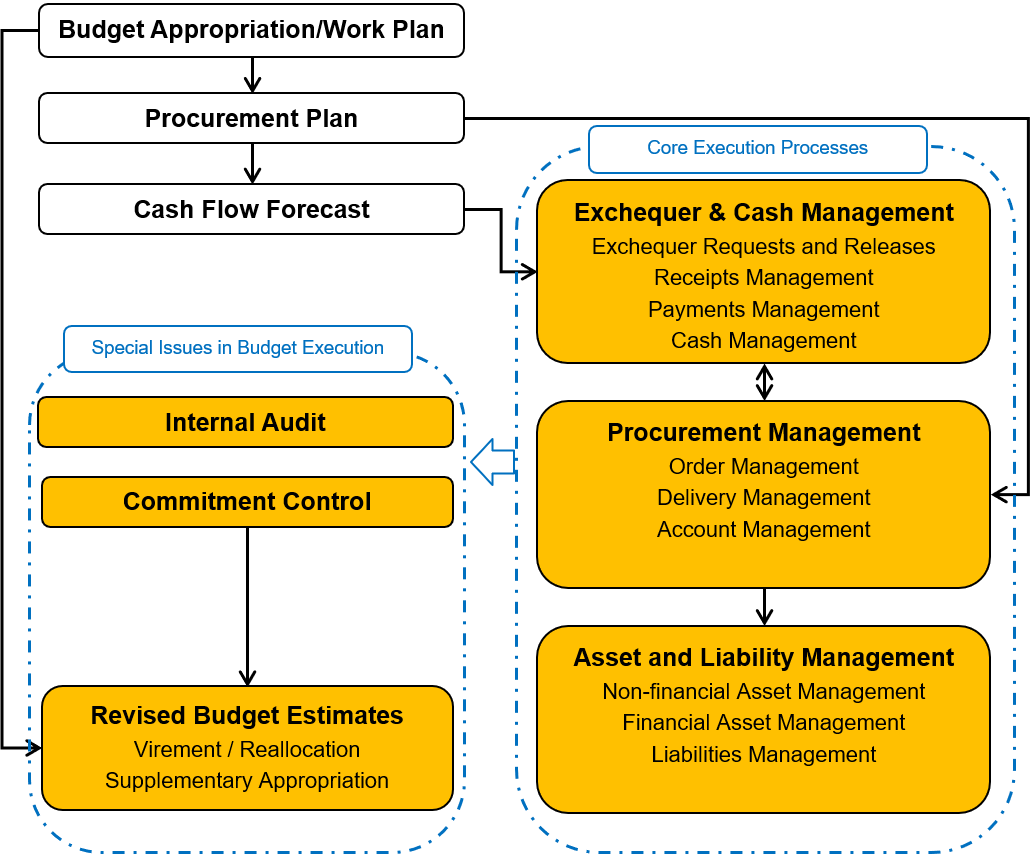

Budget Execution represents the process of giving effect to plans and budgets, through exchequer and cash management to ensure smooth government operations, the procurement of works, goods and services and the management of any assets or liabilities acquired or created. Commitment control and budget revisions are special issues that need to be taken into careful consideration during budget execution as adjustments might be needed during the year. Internal audit plays a critical role in ensuring budgets are executed in a sound internal control environment.

| 1 |

Building on cash flow forecasts, counties make exchequer requests for authorization by the Controller of Budget and release from the County Revenue Fund to the County Operations Account. Cash management involves the management of receipts deposited into the County Revenue Fund, and payments made from the County Operations Account, as well as zero-balance treasury management to ensure that no funds lie idle

|

4 |

The internal audit function is a management support function that exists to ensure the efficient and effective use of the county’s resources. It is a critical component of the internal financial controls necessary to protect the county’s financial interests, while also acting as a feedback mechanism to departments on their use of public resources.

|

| 2 |

The procurement plan is given effect through three inter-related processes: order management (from requests to tender/bid awards), delivery management (from contracting to delivery of works, good or services) and account management (involving payment to suppliers according to the contract and delivery terms).

|

5 |

Commitment control mechanisms act as a safeguard in ensuring that all transactions, especially procurement transactions, are fully funded prior to their authorization. The use of vote books is a traditionally common form of commitment control.

|

| 3 |

This covers the planning, management, recording, accounting for and disposal or settlement of assets and liabilities acquired or created by counties, as informed by relevant guidelines on asset and liability management.

|

6 |

Budget revisions may arise through reallocations (virements) between budget lines, within established and laid down parameters, or through a formal process of preparing supplementary budget estimates for approval by the County Assembly. In the latter case, approval is mandated through a supplementary budget appropriation law passed by the Assembly.

|

Budget execution at a glance

The County Executive has a prominent role in implementing what approved in the budget and delivering services. The County Finance and Economic Planning department plays a central, coordinating role: providing guidance with the Budget Implementation Circular, consolidating and managing cash flow forecasts communicating them to the National Treasury and Controller of Budget to facilitate smooth exchequer and cash management to the benefit of all county operations. Sector Departments refine their work plans, service delivery and project implementation plans, procurement plans and cash flow forecasts, and are responsible for the active stages of budget execution – day-to-day operations, procurement, and asset and liability management, within established commitment control and virement parameters. The preparation of supplementary budget estimates is led by County Finance and Economic Planning, who will draw inputs from Sector Working Groups and Departments before clearance by the County Executive Committee and submission to the County Assembly for approval and appropriation. Internal audit operates as an independent internal function within the County Executive.

The County Assembly’s role in implementation and service delivery is ensuring that its committees are aware of work plans and forecasts as a basis for tracking and monitoring against actual reports, and playing its oversight role as regards public spending. The approval of supplementary budget estimates, which is done in a similar fashion to the normal budget estimates process, implies a more proactive role of the Assembly as it draws on the inputs of Sector committees and the Budget committee before discussing and approving the supplementary budget in plenary session (full assembly) following which the relevant appropriation act is passed and enacted.

As with the County Assembly, the citizen’s role in implementation and service delivery planning is limited to awareness of published and publicized plans and forecasts as a basis for tracking and monitoring against actual reports. Revised budget estimates need to be subjected to public participation – just like regular budget estimates – before a supplementary appropriation can be approved by the Assembly. As with the original budget estimates, the citizen plays a key role in tracking the county’s focus on agreed priorities and in reviewing the explanations given by the County Executive in justifying the need for supplementary estimates and appropriation.

- Controller of Budget plays a critical role in triggering implementation through the approval of county government work plans, procurement plans and cash flow forecasts, as well as the critical authorization of exchequer releases to counties.

- The National Treasury continues to control the timing of exchequer releases (COB authorization is necessary but not sufficient) hence plays a critical role in ensuring that county governments are receiving their equitable share of national revenues in a timely fashion to ensure smooth implementation of their activities.